Australian GST Charged by UK Businesses

This letter states

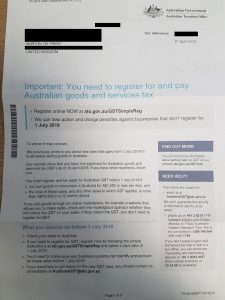

Important: You need to register for and pay Australian goods and services tax

It then goes on the state that businesses are required to register if you sell goods to consumers in Australia for A$1000 or less per item and have a GST turnover of A$75,000 or more in a 12-month period.

This can be quite a shock, especially for smaller businesses who export to Australia who will find it more difficult to put the systems in place to deal with this extra paperwork and burden. Especially as competitors may not sell enough to Australia to need to charge GST.

The deadline for registration is 1st July 2018.

How Can I Charge Australian GST In the UK?

Australian GST is currently at 10%, and this should be charged on goods and services. So for most companies selling retails goods into Australia 10% should be added to the shipping price too.

The first thing to do is to make sure that your business is registered for Australian GST. The Australian Tax Office has created a fast track registration system for overseas businesses. This can be accessed here: ato.gov.au/GSTSimpleReg.

As when charging VAT, the GST charge should be made clear at the point of purchase. This means enabling your website to charge GST at the point of checkout for goods being sent to Australia. This is a service which we can help with on Magento or Woocommerce. Your invoicing system also needs to be able to display this GST, as well as your GST number and this invoice should be placed on the outside of any shipments as per your courier’s standard requirements.

Australian GST on EBAY & Amazon

It seems that as yet, the Australian tax office have not agreed on a solution with marketplaces such as Ebay and Amazon. However both seem to fairly reluctant to play ball.

It is recommended that you contact your marketplaces to ask how you can comply with the rules.

Updating a UK Magento Store For Australian GST

If you need your Magento or Woocommerce website updating to charge GST, please contact us for a quotation.

We can make sure that the hassles are taken out of charging GST to the correct customers.

We would always recommend speaking with a tax specialist in order to get the best advice for your business.

Hi there – if you have a UK Vat registered business who is doing work for an Australian Company but the supply of the services is entirely performed in the UK then does VAT need to be charged by my client.

Thanks,

Chris

Hi Chris. Did you find an answer for this query? I am currently in that position.

thanks

Lee

Hi Chris/Lee,

We are not accountants, but as far as I’m aware, you only have to register with the ATO for GST if you exceed the $75,000 of Australian turnover in a 12-month period.

I would however recommend that you get this confirmed by a professional as this may be different for the service sector.

Hi There, if you have a UK Vat registered business who is engaging a small Australian company for a service and the service is being performed in the UK and / or Australia the Australian company will then invoice the UK Vat registered business, does VAT need to be charged by the Australian company ?

The service will not exceed AUD$75,000

Hi Fiona,

I don’t believe that there would be any VAT charged. But I’m not 100% sure on what the agreement is the other way around and whether any Australian companies have to be VAT registered in the UK so it would be worth checking with an expert.